By AlignIndia Editors

Winston Churchill is often credited with the quote “Never let a good crisis go to waste”, supposedly said in the context of the Yalta Agreement. The Indian central government, perhaps cynically seizing on the dictum, has embarked on a slew of significant policy shifts. The New Education Policy, the Environmental Impact Assessment Notification, the Acts that overhauled the Agricultural sector, the work (with an impossible deadline) on “reforming” the Indian Penal Code and Code of Criminal Procedure… the list is long.

The government has also paradoxically exploited the pandemic, with its negative impact on professional operations, to pursue vast changes in the Labour sector. Some BJP-ruled states have already legislated on the subject, despite wide-spread criticism of the curtailment of workers’ rights.

DRAFT CODE ON WAGES 2020

The central government meanwhile notified a nation-wide change in the Code on Wages in July 2020. The draft redefines the term “wage” and caps allowances at 50% of the total compensation. Effectively, it mandates that the basic pay or non-allowance part be at least 50% of total compensation.

The proposed changes would modify a recently enacted law, The Code on Wages, 2019 which received the President’s assent on 8 August 2019. The 2019 code had replaced four different laws (Payment of Wages Act, 1936; Minimum Wages Act, 1948; Payment of Bonus Act, 1965 and Equal Remuneration Act, 1976). Proposing revisions in a law notified less than a year prior calls into question the intent behind the modifications.

PRIMARY IMPACT OF WAGE CODE CHANGES

The draft has worrying ramifications for salaried employees across India. The first of course is the impact of increase in basic pay on net monthly take-home salaries. The mandatory contributions to the Employees’ Provident Fund from employees and employers will increase too. An associated increase in gratuity will also affect the gross cost of an employee to the employer.

Employers will be forced to reduce allowances to adhere to the proposed change. This would reduce the net income an employee takes home every month. While the increase in pension contributions will mean a larger corpus for the employee in the long run, the amount an employee saves from the take-home salary will go down, thus cancelling out the long-term benefit.

To pay for the increased pension and gratuity liabilities, employers might even be forced to reduce the remaining components of the cost of the employee to the company – those which constitute the gross monthly salary of the employee.

According to reports, various enterprises and employers have asked the Labour Ministry to change the definition of “basic pay” – once the new rules are implemented, they will put substantial pressure on employers’ financial resources.

IMPACT ON EMPLOYERS

Most companies structure salaries in such a way that the portion of allowances is higher than the basic pay. As the portion of the basic pay increases, as per the Wage Code, companies will have to pay extra to match the contribution of the employees towards their PF and gratuity.

According to Kamal Karanth, co-founder of specialist staffing firm Xpheno, the new Code may also result in increased compliance costs and penalties. Gratuity benefits for senior executives are estimated to rise by around 1.5 times. The increased workforce cost will be accompanied by a one-time cost increase for employers – they would be forced to audit their current pay structures and re-align it with the new Code. Other analysts have estimated that the overall costs for companies may increase up by at least 10-12%. The extra financial burden on companies comes at a time when many industries, sectors and companies are still reeling under the impact of the pandemic and the sudden imposition of a lockdown.

What compounds the worries of employers and companies is that the Indian economy shows no visible green shoot of recovery. After declining at 24% between April and June, India’s GDP growth contracted by 7.5% between July and September, thus entering technical recession territory and pushing the economy closer to a sustained period of recession. The Reserve Bank of India (RBI) has estimated that the economy will contract by 9.5% during FY 2020-2021.

Most companies are likely to restructure the salaries of their employees to minimise the extra financial burden, and the exercise will involve extra resources and time.

SECONDARY IMPACT OF WAGE CODE CHANGES

Many salaried professionals have loans to pay that constitute a significant part of their monthly income. The impact of the notified draft code will be profound in such situations – individuals will be forced to choose between unappealing scenarios, none of which deliver benefits to them.

This cannot come at a worse juncture: the CMIE, in July 2020, estimated average income losses in middle class households to be at 30% due to the current economic climate. Simultaneously, the unrelenting rise in fuel prices, thanks to hikes in cess and tax, directly and indirectly inflated the expenses of every Indian.

With tax relief unlikely in the near term, Indians face the dismal prospect of battling increased expenditure and decreasing monthly income.

Besides, even without the Wage Code changes, SBI’s Ecowrap projected that India’s per capita income will decline by 5.4% in FY21 to Rs 1.43 lakh. This regressive move thus targets the very people impacted most by previous economic mis-steps – the salaried middle-class.

With his “minimum government, maximum governance” strategy driving a series of economic debacles, Narendra Modi and his cabinet have been collectively deciding how the hard-earned money of the middle class should be spent and saved.

IMPACT ON CONSUMPTION

Salaried professionals are likely to spend less starting from April 2021. This will certainly dash any hopes for a consumption-led economic revival next year. The Indian economy was already crushed – 2017-18 had marked the lowest overall consumption demand in over four decades. Meanwhile, urban consumer spending shrank by 34%, year-on-year, in April-June 2020, and by 18% in July-August 2020, according to SBI Research. They went on to project that this unprecedented downfall can fuel inflation and precluded any real GDP growth in the near term.

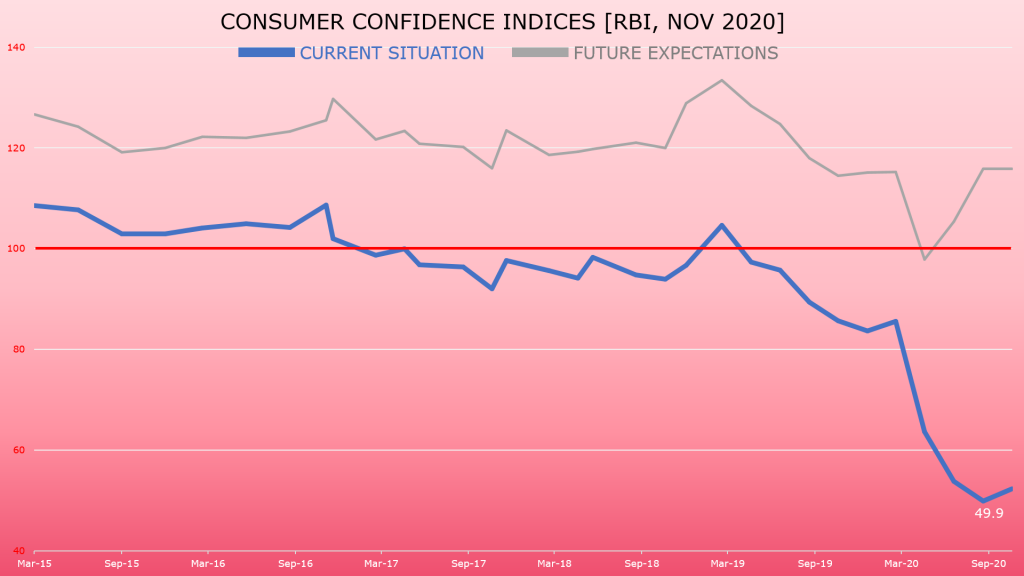

The bad news kept coming – consumer confidence plummeted to a historic low in September 2020, for the third month running. In May 2020, at the height of the lockdown, 53.4% of respondents to the RBI survey reported that their incomes had decreased. This percentage grew steadily to a high of 63.1% in November.

CONCLUSION

It is virtually impossible to extract an iota of comfort from the Draft Code on Wages 2020. The economic and social context in which it was notified is full of gloom and no hope for the short-term. It marks a new low in the BJP government’s cynical exploitation of a health crisis to push myopic changes, this time in the labour sector. Vast sections of Indian society will approach FY21 with trepidation – household costs going up constantly will combine disastrously in April 2021 with salaried income going down. Indian enterprises and employers have to make massive operational changes in preparation, and will simultaneously face shrinking consumption prospects.

All in all, the Draft Code on Wages 2020 underlines the economic ineptness this BJP government has demonstrated consistently ever since 2014.